Your salary slip, also called a payslip, is a paper that shows how much money you get from your job and what gets taken out. Every month, your boss gives you a payslip with important info like the company’s name, your job title, where you work, and your bank details.

Inside your payslip, there’s stuff like what you earn and what’s subtracted. What you earn includes your basic pay, extra pay for living expenses, house rent help, medical help, and any other extras. What’s taken out might be taxes, money for retirement savings, or other stuff. Remember, these details can change depending on where you work.

Why is your payslip important?

Well, it helps you understand your money better. It’s not just for loans; it helps you when you’re thinking about changing jobs, figuring out taxes, or knowing how much you’re saving. Understanding your payslip means you can make smart choices about your money.

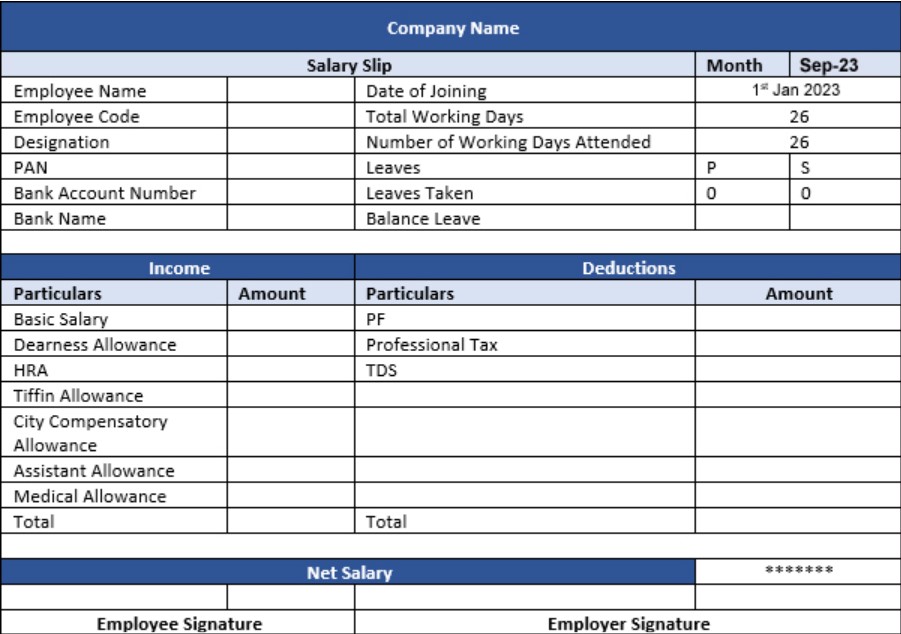

Salary Slip Format

Some important things on your payslip

- Basic Salary: This is the main part of your pay. It might be a big chunk of what you get. It’s taxable, which means you have to pay tax on it. As you move up in your job, other types of pay might become more important.

- Living Cost Help (DA): This changes based on how expensive things are. It tries to keep up with the rising prices so you can still afford stuff. It’s also taxable.

- House Rent Help (HRA): If you rent your home, this helps you pay for it. You might not have to pay tax on some of it, depending on how much rent you pay.

- Travel Help (Conveyance Allowance): This helps with the cost of getting to work. You might not have to pay tax on some of it, up to a limit.

- Medical Help: This helps you pay for medical stuff. You might not have to pay tax on some of it, if you show receipts.

- Leave Travel Allowance (LTA): This helps with travel costs when you’re on vacation. It’s like a bonus for taking time off.

- Special Allowance: This is extra money your boss might give you for doing a great job. It’s taxable, but it shows they appreciate your work.

Now, let’s talk about what gets taken out

- Provident Fund (PF): This is money you save for later, like for retirement. Both you and your boss put some money into it.

- Professional Tax: This is a tax some states charge on your income.

- Tax Deducted at Source (TDS): This is tax taken out of your pay before you get it. It helps make sure you pay your taxes on time.

- Employee State Insurance (ESI): This helps with medical stuff if you’re having a tough time. You and your boss both put some money into it.

Salary Slip Formulas

Here are some easy formulas for making a salary slip in Excel. These formulas will help you figure out how much money you earn before and after deductions.

Parts of Salary Slip and Their Formulas

- Taxable Income: Gross Salary minus Deductions

- CTC (Cost to Company): Total salary package including Gross Salary, EPF, Gratuity, and others

- Gross Salary: Basic Salary plus HRA (House Rent Allowance) plus Other Allowances

- Net Salary: Gross Salary minus Income Tax, EPF, Professional Tax, plus HRA and Allowances

Difference Between CTC and Gross Salary

- CTC (Cost to Company): Includes everything a company spends on an employee, like salary and benefits.

- Gross Salary: Total payment to an employee before taxes, but includes deductions like EPF and ESI.

Why Salary Slips are Important

Salary slips are crucial documents in the professional world. They prove you’re a salaried employee, which is important for many official purposes like visa applications and background checks. Here’s why they matter:

- Proof of Employment: Shows your job status and history.

- Tax Planning: Helps you understand your earnings and deductions for better tax planning.

- Negotiating Salaries: Useful during salary talks with employers.

- Financial Transactions: Essential for getting loans and managing finances.

Conclusion

Salary slips are essential for all employees. However, many Indian employees don’t get them, which can make it difficult for them to access loans and other financial services.